As we discussed in a prior post, three parts of the SEC’s 2020 MD&A modernization have become focus areas in the comment process:

-

- Critical accounting estimate disclosures

- Quantitative and qualitative disclosures about material changes

- Meaningfully addressing liquidity and capital resources

We also explored how one of the reasons behind this increase in MD&A comments could be that companies are reluctant to change MD&A, even when the change is to comply with a new rule or to improve MD&A!

In an earlier post we explored a comment letter exchange focused on critical accounting estimate disclosures.

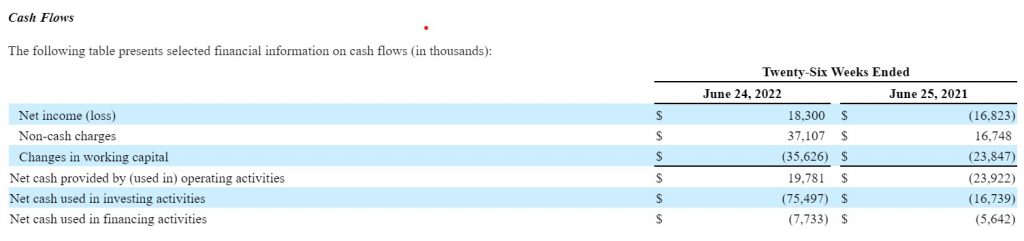

Today’s post presents an example comment and company response for the second of these three areas, providing quantitative and qualitative disclosures about material financial statement changes.

The Regulation S-K Item 303 guidance for this disclosure is very direct:

Where the financial statements reflect material changes from period-to-period in one or more line items, including where material changes within a line item offset one another, describe the underlying reasons for these material changes in quantitative and qualitative terms.

Companies frequently describe qualitative factors behind changes without quantitative information to explain their relative magnitude. While this has been a frequent comment area before the 2020 change, it has become the source of even more comments now that there is an objective requirement in S-K Item 303. This is clearly an easily avoided comment.

Here is an example disclosure from a company’s Form 10-K that generated a comment to provide both quantitative and qualitative information.

Voyage expenses

To the extent that we employ our vessels on voyage charters, we incur expenses that include but are not limited to bunkers, port charges and canal tolls, as these expenses are borne by the vessel owner on voyage charters. Bunkers, port charges, and canal toll expenses primarily increase in periods during which more vessels are employed on voyage charters.

Voyage expenses for the year ended December 31, 2021 were $104.6 million, compared with $89.5 million for the year ended December 31, 2020. Voyage expenses have primarily increased due to an increase in bunker consumption expense, an increase in broker commission expense and an increase in port expenses.

The SEC’s comment is simple and direct:

Results of Operations for Years Ended December 31, 2021 and 2020, page 78

-

- We note that you list multiple factors that contribute to changes in your results. For example, you disclose several factors contributing to the increase in voyage expense. Revise your disclosure to quantify each material factor that contributes to a change in your revenues or expenses. Refer to Item 303(b) of Regulation S-K.

The company’s response is also simple and direct, as well as detailed:

The Company acknowledges the Staff’s comment and undertakes in future filings to include additional information to quantify material factors that contribute to a change in our revenues or expenses. To illustrate the Company’s intention with respect to such disclosure, we have provided below the relevant portions of the 2021 Form 10-K, revised to include such additional information (with underlined and strikethrough text indicating additions and deletions, respectively):

Voyage expenses

To the extent that we employ our vessels on voyage charters, we incur expenses that include but are not limited to bunkers, port charges and canal tolls, as these expenses are borne by the vessel owner on voyage charters. Bunkers, port charges, and canal toll expenses primarily increase in periods during which more vessels are employed on voyage charters.

Voyage expenses for the year ended December 31, 2021 were $104.6 million, compared with $89.5 million for the year ended December 31, 2020. Voyage expenses have primarily increased primarily due to an increase in bunker consumption expense of $8.0 million, which was driven by an increase in bunker fuel prices, an increase in broker commission expense of $4.6 million, which was driven by an increase in related revenues, and an increase in port expenses of $2.0 million, which was driven by an increase in the number of voyage days.

Our next post will explore the third of these frequent comment areas, liquidity and capital resources discussions.

As always, your thoughts and comments are welcome!