On December 2, 2025, SEC Chairman Paul S. Atkins delivered a speech at the New York Stock Exchange titled “Revitalizing America’s Markets at 250.” In his speech he discusses the history of our country and capital markets, addressees the impact of disclosure regulation, and enumerates possible disclosure reforms.

In one section of his remarks Chairman Atkins states:

“Over the years, and particularly over the past two decades, special interest groups, politicians, and—at times—the SEC itself have weaponized the disclosure regime that Congress created for our marketplace, in an effort to advance social and political agendas that stray far from the SEC’s mission of facilitating capital formation; protecting investors; and ensuring fair, orderly, and efficient markets.”

He also states:

“One of my priorities as Chairman is to reform the SEC’s disclosure rules with two goals in mind. First, the SEC must root its disclosure requirements in the concept of financial materiality. Second, these requirements must scale with a company’s size and maturity.”

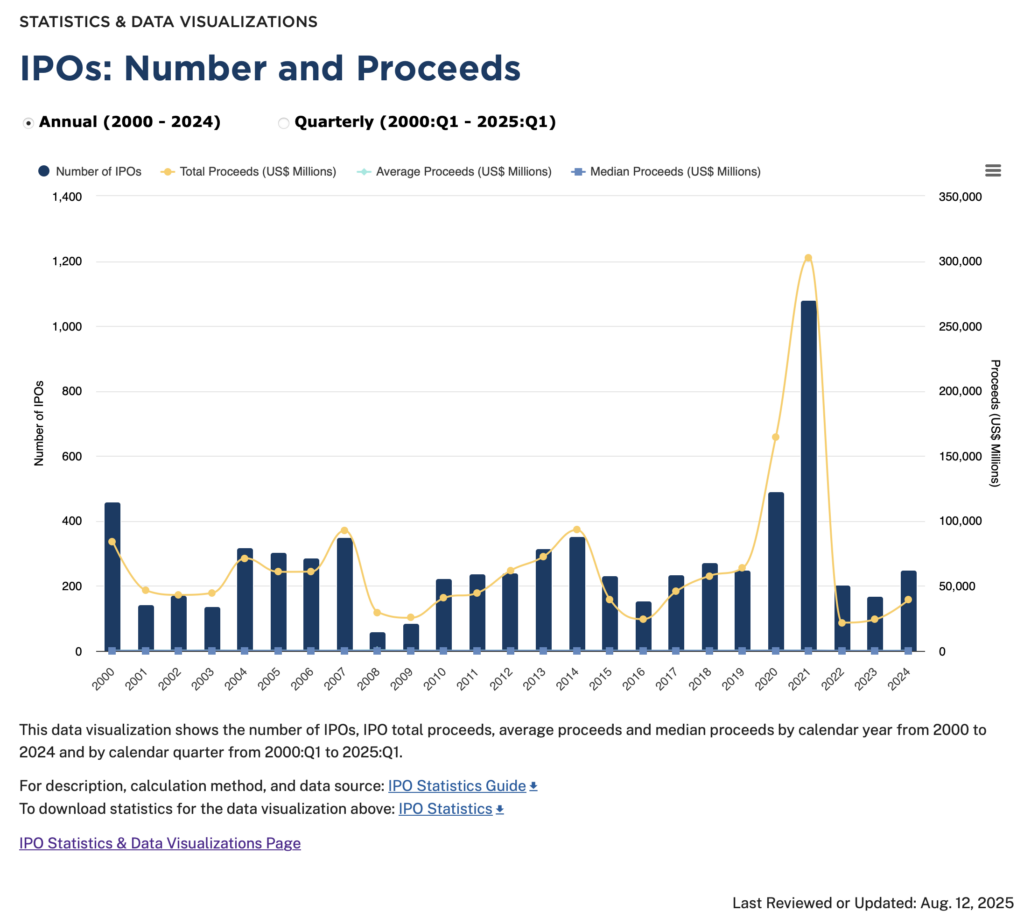

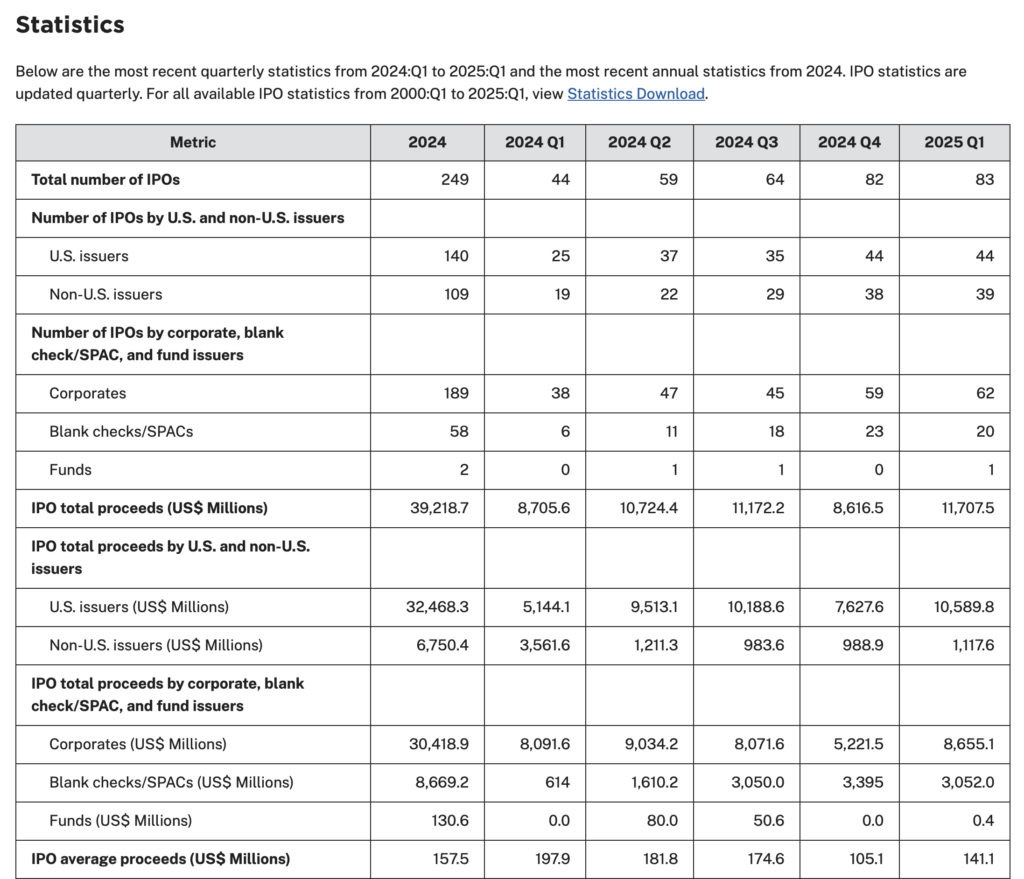

He then outlines areas for possible reform, including simplifying executive compensation disclosures, scaling disclosure rules based on company size, and expanding the IPO on-ramp.

As always, your thoughts and comments are welcome!