As we discussed in this earlier post, the SEC’s October 2022 “Listing Standards for Recovery of Erroneously Awarded Compensation” rules will require companies whose securities are listed on national securities exchanges to develop and adopt policies for the recovery or “clawback” of incentive compensation that has been “erroneously awarded” when a company restates its financial statements. The Dodd-Frank Act required the SEC to implement these requirements through listing standards that national securities exchanges will soon be required to adopt.

Based on the final rules’ January 27, 2023, effective date, the timetable for implementation of the clawback rules, including the adoption of a clawback policy by exchange-listed companies, will be:

-

- February 26, 2023 – last day by which national securities exchanges are to file proposed clawback listing standards;

- November 28, 2023 – last day by which clawback listing standards must become effective; and

- January 27, 2024 – last day by which listed companies must adopt and comply with an appropriate clawback policy.

Of course, if the exchange listing standards become effective earlier than the November 28, 2023 deadline, companies will have to adopt policies before January 27, 2024.

This earlier post discusses the implementation process in more detail and includes a policy template to help companies get a head start in this process.

This current post reviews the rules’ new disclosures:

-

- First, if during or after the last completed fiscal year, a company is required to prepare an accounting restatement that requires recovery of “erroneously awarded” compensation, or, as of the last completed fiscal year, there was an outstanding balance of “erroneously awarded compensation” still to be recovered from a prior restatement, the required disclosures include:

- The date of the restatement;

- The dollar amount of compensation required to be clawed back;

- Details of the calculation of compensation subject to clawback;

- If the financial reporting measure in a compensation plan subject to clawback related to a stock price or total shareholder return, details of the estimates used in determining clawback amounts and the methodology used for these estimates;

- The dollar amount of any “erroneously awarded compensation” outstanding at the end of the last completed fiscal year; and

- If the dollar amount of compensation subject to clawback has not yet been determined, disclose this information, including an explanation of why the amount could not be determined. The required information should then be disclosed in the next report requiring compensation disclosure pursuant to Item 402 of Regulation S-K.

- Second, when a company determines, based on the limited practicability exceptions in the rules, that clawback would be impracticable, it must disclose the amount of the compensation recovery not pursued for each executive officer and all executive officers as a group, along with a description of why recovery was not pursued.

- Third, disclosure must include amounts that, as of the end of the most recently completed fiscal year, have been outstanding for 180 days or more from any current or former named executive officer.

- Fourth, if a company has a restatement and concludes that clawback of compensation is not required for that restatement, it must disclose how it arrived at that conclusion.

In addition to the disclosures described above, each listed company must file its clawback policy as Exhibit 97 to Form 10-K. These new disclosures are to be tagged with Inline XBRL and will also be required in Forms 20-F and 40-F. Note that this will not be required until after the company is required to adopt a clawback policy, which could be as late as January 27, 2024.

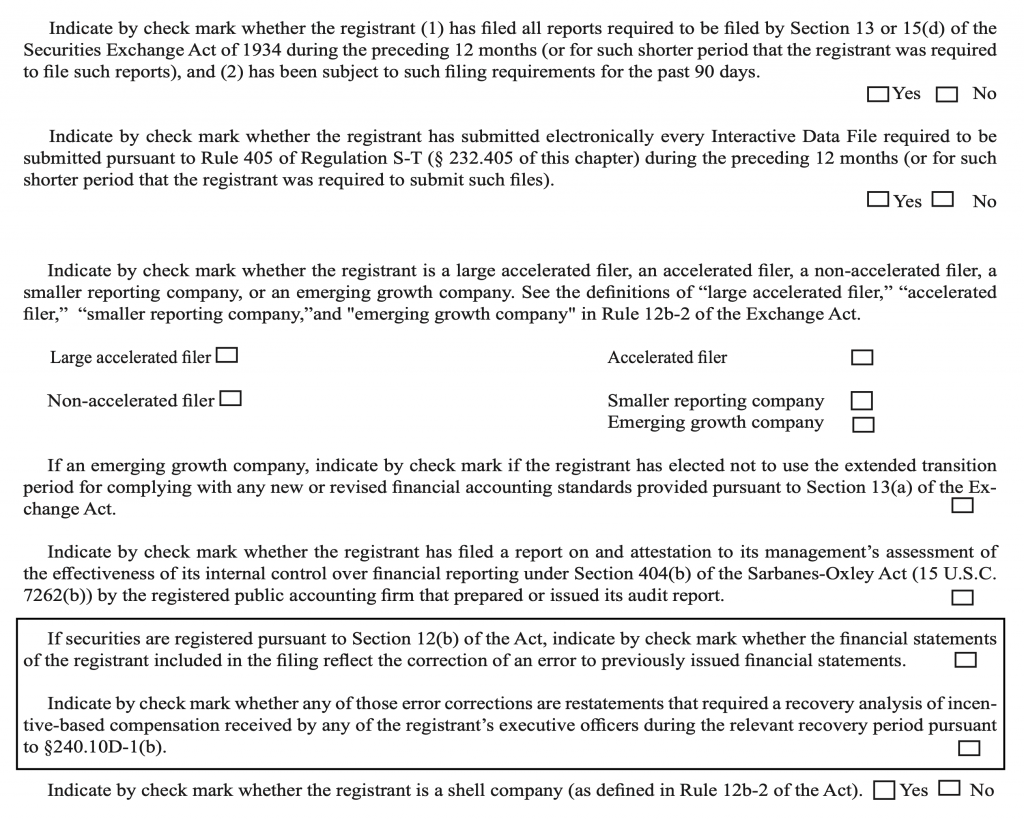

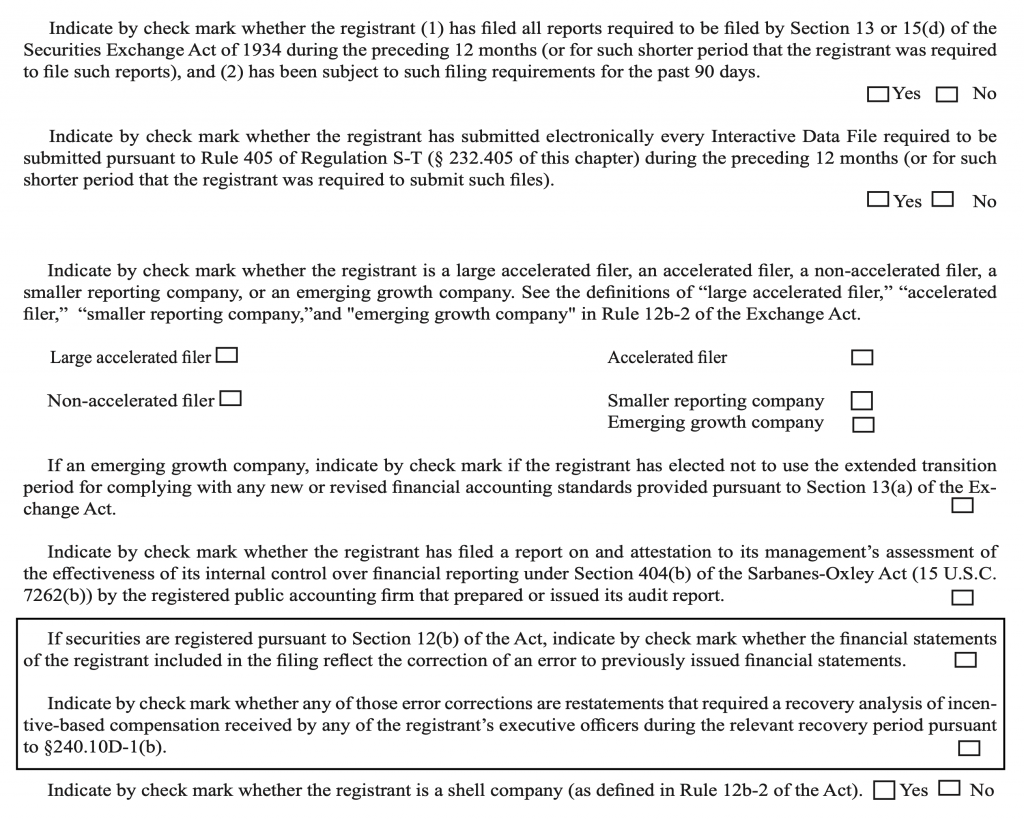

Furthermore, the rules add two new checkboxes to the cover pages of Form 10-K, Form 20-F and Form 40-F. These forms were updated on January 27, 2023, the effective date of the new rules. Below is the revised section of the cover page of Form 10-K from the SEC’s webpage:

Also, on January 31, 2023, the staff issued several new C&DIs addressing these new disclosures. One of the C&DIs addresses the form amendments:

Question 104.19

Question: The form amendments adding check boxes to the cover page of Form 10-K, Form 20-F, and Form 40-F indicating whether the form includes the correction of an error in previously issued financial statements and a related recovery analysis are effective January 27, 2023. However, the listing standards are not required to be effective until November 28, 2023 and issuers subject to such listing standards will not be required to adopt a recovery policy for 60 days following the date on which the applicable listing standards become effective. Will issuers be required to mark the check boxes in 2023 before an issuer is required to adopt a recovery policy and comply with the applicable listing standards?

Answer: In the adopting release, the Commission indicated that it does not expect compliance with the disclosure requirements until issuers are required to have a recovery policy under the applicable exchange listing standard. While the check boxes and other disclosure requirements will be in the rules and forms in 2023, we do not expect issuers to provide such disclosure until they are required to have a recovery policy under the applicable listing standard. [January 31, 2023]

Because disclosure is not required until after a listed company is required to adopt a clawback policy, whether to add the new checkboxes on the cover page of your annual report is essentially an “it depends” decision. We believe that the better practice is to include the new checkboxes as they are now on the official form. Some companies, however, may decide not to include them since the underlying disclosure requirement is not effective until after the company is required to adopt a clawback policy. Assuming that the EDGAR system allowed such a submission, that would, in essence, make both answers allowable.

Non-listed companies have similar considerations about inclusion of the checkboxes on the form cover but they will not have to check either of the boxes. The first box would not apply – they do not have “Section 12(b)” (i.e., listed) securities. Then, even if they had a restatement, the second box would not apply because it would not be “required.” Should non-listed companies not have a clawback policy – we’re not saying that adoption of a clawback policy might not be a wise move as a matter of good governance practices. But even if they do – these rules will not apply to them.

As always, your thoughts and comments are welcome!