As we overviewed in the first post in this series, in late 2022 and early 2023, the SEC adopted four Final Rules that created a raft of new and detailed reporting requirements in Forms 10-Q and 10-K.

This is the third of five posts that provide details and suggestions to help companies analyze and implement these changes in upcoming periodic reports. This post goes into detail about the disclosure changes from the SEC’s October 2022 Final Rule “Listing Standards for Recovery of Erroneously Awarded Compensation.”

And, to help keep track of the topics we will explore, here is a reminder list of our current and future posts in this series to help you implement all these new disclosure requirements:

Current posts:

-

- So Many Form 10-Q and 10-K Changes! [Part 1 of 5]

-

- Listing Standards for Recovery of Erroneously Awarded Compensation Disclosures [This post – Part 3 of 5]

Future posts:

-

- Share Repurchase Disclosure Modernization [Part 4 of 5]

- Pay Versus Performance Disclosures (Proxy statement only disclosures) [Part 5 of 5]

As a preliminary note, as you read this post, the Listing Standards for Recovery of Erroneously Awarded Compensation Final Rule does not create any new disclosures in Form 10-Q.

Details of Form 10-K Changes for Listing Standards for Recovery of Erroneously Awarded Compensation

The four changes to Form 10-K from Listing Standards for Recovery of Erroneously Awarded Compensationare:

-

- 1. Two new check boxes on the cover page related to clawback disclosures:

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. □

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). □

These boxes have already been added to the cover of the 10-K. As they are on the official form, all filers should include them on the cover page. However, they will apply only to issuers with exchange-listed securities. Additionally, for those issuers, no response to the disclosures is required until after October 2, 2023, when the exchange listing standards become effective.

-

- 2. Item 11. Executive Compensation. – now requires details of any recovery of erroneously awarded compensation (S-K 402(w)), and related changes to executive compensation disclosures. These disclosures are required on or after December 1, 2023 for issuers who have securities listed on a national securities exchange.

-

- 3. Item 13. Certain Relationships and Related Transactions, and Director Independence. – has administrative updates related to recovery of erroneously awarded compensation (S-K Item 404, Instruction 5a). The transition is the same as number 2 above.

-

- 4. Item 15. Exhibit and Financial Statement Schedules. – includes new exhibit 97 for clawback policies. The transition is the same as number 2 above.

1. As mentioned above, the new cover page check boxes are in place now. You can find the current version of the Form 10-K Instructions here. You can read more about the checkboxes and review CorpFin’s related Compliance and Disclosure Interpretations in this blog post.

2. The mechanics of the change to Item 11. Executive Compensation do not require any updates to the instructions to the form, as the Item 11 instructions already refer to S-K Item 402. New paragraph (w) has been added to S-K item 402.

S-K Item 402(w) requires the following disclosures:

(w) Disclosure of a registrant’s action to recover erroneously awarded compensation.

(1) If at any time during or after the last completed fiscal year the registrant was required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the registrant’s compensation recovery policy required by the listing standards adopted pursuant to 17 CFR 240.10D-1, or there was an outstanding balance as of the end of the last completed fiscal year of erroneously awarded compensation to be recovered from the application of the policy to a prior restatement, the registrant must provide the following information:

(i) For each restatement:

(A) The date on which the registrant was required to prepare an accounting restatement;

(B) The aggregate dollar amount of erroneously awarded compensation attributable to such accounting restatement, including an analysis of how the amount was calculated;

(C) If the financial reporting measure as defined in 17 CFR 240.10D-1(d) related to a stock price or total shareholder return metric, the estimates that were used in determining the erroneously awarded compensation attributable to such accounting restatement and an explanation of the methodology used for such estimates;

(D) The aggregate dollar amount of erroneously awarded compensation that remains outstanding at the end of the last completed fiscal year; and

(E) If the aggregate dollar amount of erroneously awarded compensation has not yet been determined, disclose this fact, explain the reason(s) and disclose the information required in paragraphs (w)(1)(i)(B) through (D) of this section in the next filing that is required to include disclosure pursuant to Item 402 of Regulation S-K;

(ii) If recovery would be impracticable pursuant to 17 CFR 240.10D-1(b)(1)(iv), for each current and former named executive officer and for all other current and former executive officers as a group, disclose the amount of recovery forgone and a brief description of the reason the listed registrant decided in each case not to pursue recovery; and

(iii) For each current and former named executive officer from whom, as of the end of the last completed fiscal year, erroneously awarded compensation had been outstanding for 180 days or longer since the date the registrant determined the amount the individual owed, disclose the dollar amount of outstanding erroneously awarded compensation due from each such individual.

(2) If at any time during or after its last completed fiscal year the registrant was required to prepare an accounting restatement, and the registrant concluded that recovery of erroneously awarded compensation was not required pursuant to the registrant’s compensation recovery policy required by the listing standards adopted pursuant to 17 CFR 240.10D-1, briefly explain why application of the recovery policy resulted in this conclusion.

(3) The information must appear with, and in the same format as, the rest of the disclosure required to be provided pursuant to this Item 402. The information is required only in proxy or information statements that call for Item 402 disclosure and the registrant’s annual report on Form 10-K, and will not be deemed to be incorporated by reference into any filing under the Securities Act, except to the extent that the listed registrant specifically incorporates it by reference.

(4) The disclosure must be provided in an Interactive Data File in accordance with Rule 405 of Regulation S-T and the EDGAR Filer Manual.

In addition to new paragraph S-K Item 402(w), the Recovery of Erroneously Awarded Compensation rule makes two changes to adjust disclosures in the Summary Compensation Table for recovered amounts:

Instructions to Item 402(c).

-

-

- Reduce the amount reported in the applicable Summary Compensation Table column for the fiscal year in which the amount recovered initially was reported as compensation by any amounts recovered pursuant to a registrant’s compensation recovery policy required by the listing standards adopted pursuant to 17 CFR 240.10D-1, and identify such amounts by footnote.

-

Instructions to Item 402(n).

-

-

- Reduce the amount reported in the applicable Summary Compensation Table column for the fiscal year in which the amount recovered initially was reported as compensation by any amounts recovered pursuant to the compensation recovery policy required by the listing standards adopted pursuant to 17 CFR 240.10D-1, and identify such amounts by footnote.

-

3. The mechanics of the change to Item 13. Certain Relationships and Related Transactions, and Director Independence do not require any updates to the instructions to the form, as the Item 13 instructions already refer to S-K Item 404. New instruction 5.a.iii has been added to S-K item 404, and provides an exception to related transaction reporting if a transaction relates to a clawback event and has been appropriately reported:

Instructions to Item 404(a). * * * 5.a. * * *

5.a. Disclosure of an employment relationship or transaction involving an executive officer and any related compensation solely resulting from that employment relationship or transaction need not be provided pursuant to paragraph (a) of this Item if:

***

iii. The transaction involves the recovery of erroneously awarded compensation computed as provided in 17 CFR 240.10D-1(b)(1)(iii) and the applicable listing standards for the registrant’s securities, that is disclosed pursuant to Item 402(w) (§229.402(w)).

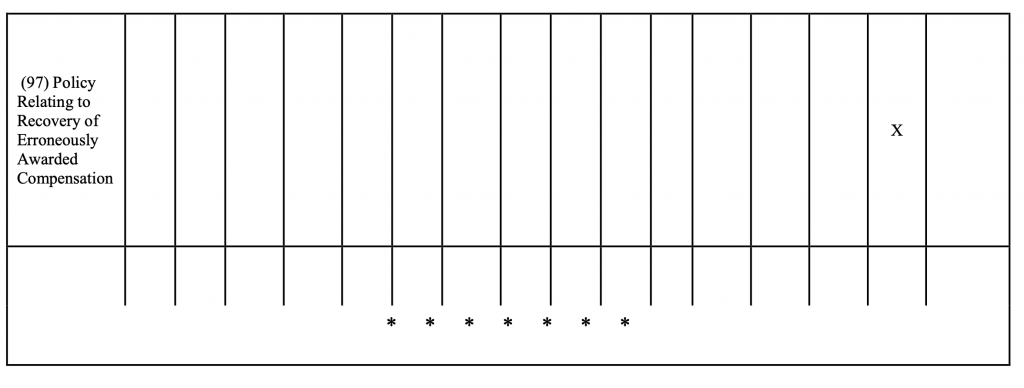

4. The mechanics of the change to Item 15. Exhibit and Financial Statement Schedules are to add new exhibit 97:

(b) * * *

(97) Policy relating to recovery of erroneously awarded compensation. A registrant that at any time during its last completed fiscal year had a class of securities listed on a national securities exchange registered pursuant to section 6 of the Exchange Act (15 U.S.C. 78f) or a national securities association registered pursuant to section 15A of the Exchange Act (15 U.S.C. 78o-3) must file as an exhibit to its annual report the compensation recovery policy required by the applicable listing standards adopted pursuant to 17 CFR 240.10D-1.

You can read more about the adoption of appropriate clawback policies and find a link to a template policy in this blog post.

As always, your thoughts and comments are welcome!