As we overviewed in the first post in this series, in late 2022 and early 2023, the SEC adopted four Final Rules that created a raft of new and detailed reporting requirements in Forms 10-Q and 10-K.

This is the fourth of five posts that provide details and suggestions to help companies analyze and implement these changes in upcoming periodic reports. This post goes into detail about the disclosure changes from the SEC’s May 2023 Final Rule “Share Repurchase Disclosure Modernization.”

And, to help keep track of the topics we will explore, here is a reminder list of our current and future posts in this series to help you implement all these new disclosure requirements:

Current posts:

-

-

- Share Repurchase Disclosure Modernization [This post – Part 4 of 5]

Future post:

-

- Pay Versus Performance Disclosures (Proxy statement only disclosures) [Part 5 of 5]

As a preliminary note, as you read this post you will see that the new disclosures for share repurchases are the same in Forms 10-K and 10-Q.

Details of Form 10-Q Changes for Share Repurchase Disclosure Modernization

The three changes to Form 10-Q from the Share Repurchase Disclosure Modernization Final Rule are:

1. Part II – Item 2. Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities. The old month-by-month table of share repurchases has been removed. New language in S-K Item 703 requires narrative disclosure of the rationale and purpose of share repurchases. These changes are effective for the first full fiscal quarter beginning on or after October 1, 2023 (Note: As discussed in the 10-K section below, this disclosure is required for all quarters, including the fourth quarter. Thus, the first time that this will appear for calendar year-end companies is the 10-K for the year ended December 31, 2023).

(Note: As noted below, new exhibit 26 requires details of share repurchases.)

2. Part II – Item 5. Other Information now requires disclosure of company Rule 10b5-1 plans. The transition for this new disclosure is the same as for number 1 above.

3. Part II – Item 6 – Exhibits. New exhibit 26 requires daily details of share repurchases. The transition for this new disclosure is the same as for number 1 above.

1. The mechanics of the change to Part II – Item 2. Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities, begin with this new paragraph (c) to the instructions to the form:

Item 2. Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities.

***

(c) Furnish the information required by Item 703 of Regulation S-K (§ 229.703 of this chapter) for any repurchases made in the quarter covered by the report.

Regulation S-K Item 703 had been revised to remove the old monthly repurchase table and now provides:

229.703 (Item 703) Purchases of equity securities by the issuer and affiliated purchasers.

(a) Disclose the specified information in narrative form with respect to the issuer’s repurchases of equity securities disclosed pursuant to § 229.601(b)(26) (Item 601(b)(26) of Regulation S-K) and refer to the particular repurchases in the table in Item 601(b)(26) of Regulation S-K that correspond to the different parts of the narrative, if applicable:

(1) The objectives or rationales for each repurchase plan or program and the process or criteria used to determine the amount of repurchases.

(2) The number of shares (or units) purchased other than through a publicly announced plan or program, and the nature of the transaction (e.g., whether the purchases were made in open-market transactions, tender offers, in satisfaction of the issuer’s obligations upon exercise of outstanding put options issued by the issuer, or other transactions).

(3) For publicly announced repurchase plans or programs:

(i) The date each plan or program was announced;

(ii) The dollar amount (or share or unit amount) approved;

(iii) The expiration date (if any) of each plan or program;

(iv) Each plan or program that has expired during the period covered by the table in Item 601(b)(26) of Regulation S-K;

(v) Each plan or program the issuer has determined to terminate prior to expiration, or under which the issuer does not intend to make further purchases.

(4) Any policies and procedures relating to purchases and sales of the issuer’s securities by its officers and directors during a repurchase program, including any restrictions on such transactions.

(b) The disclosure provided pursuant to paragraph (a) of this section must be provided in an Interactive Data File as required by § 232.405 of this chapter (Rule 405 of Regulation S-T) in accordance with the EDGAR Filer Manual.

2. The mechanics of the change to Part II – Item 5. Other Information, begin with the addition of this new paragraph (c) to the instructions to the form, which refers to new S-K Item 408(d):

Item 5. Other Information.

*****

(c) Furnish the information required by Items 408(a) and 408(d) of Regulation S-K ((§§ 229.408(a) and 229.408(d)).

Regulation S-K Item 408 now includes new paragraph (d) requiring disclosure of company use of Rule 10b5-1 plans.

229.408 (Item 408) Insider trading arrangements and policies.

*****

(d)(1) Disclose whether, during the registrant’s last fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report), the registrant adopted or terminated any Rule 10b5-1 trading arrangement as that term is defined in paragraph (a)(1)(i) of this section. In addition, provide a description of the material terms of the Rule 10b5-1 trading arrangement (other than terms with respect to the price at which the party executing the Rule 10b5-1 trading arrangement is authorized to trade), such as:

(i) The date on which the registrant adopted or terminated the Rule 10b5-1 trading arrangement;

(ii) The duration of the Rule 10b5-1 trading arrangement; and

(iii) The aggregate number of securities to be purchased or sold pursuant to the Rule 10b5-1 trading arrangement.

Note 1 to paragraph (d)(1): If the disclosure provided pursuant to § 229.703 contains disclosure that would satisfy the requirements of paragraph (d)(1) of this section, a cross- reference to that disclosure will also satisfy the requirements of paragraph (d)(1).

(2) The disclosure provided pursuant to paragraph (d)(1) of this section must be provided in an Interactive Data File as required by § 232.405 of this chapter (Rule 405 of Regulation S-T) in accordance with the EDGAR Filer Manual.

3. The mechanics of the change to Part II – Item 6 – Exhibits are to add new exhibit 26:

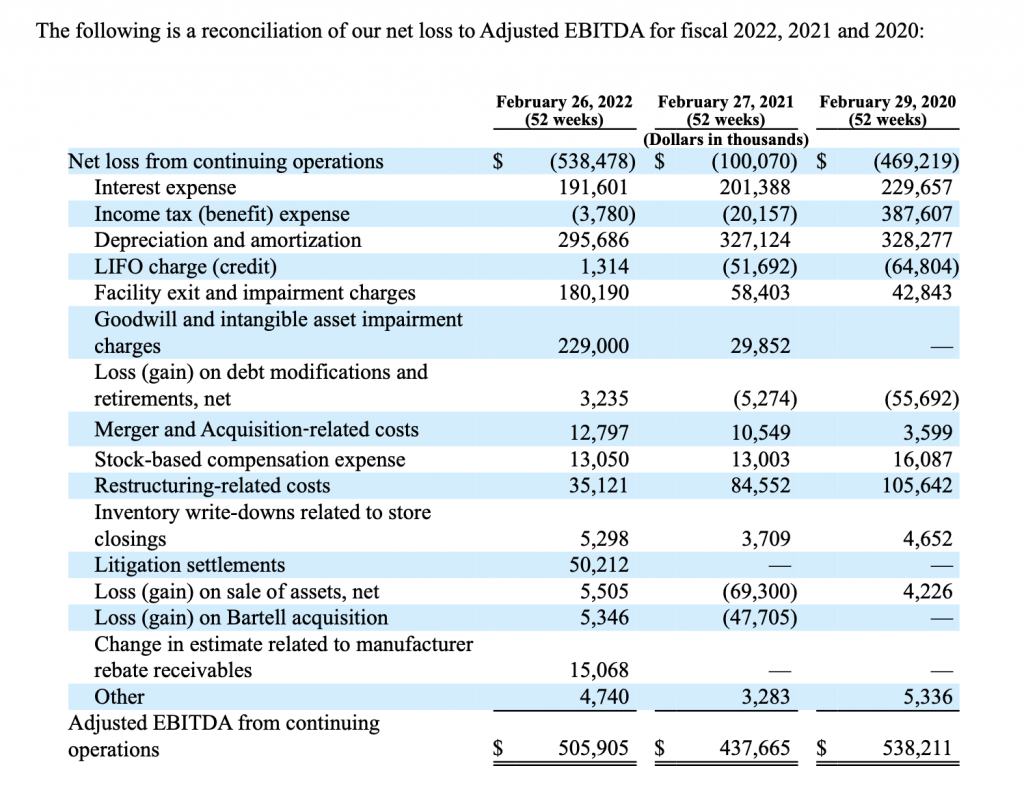

New exhibit 26 provides for many details about daily repurchases which are summarized in this table. The detailed instructions to the exhibit are included at the end of this post.

ISSUER PURCHASES OF EQUITY SECURITIES

Use the checkbox to indicate if any officer or director reporting pursuant to section 16(a) of the Exchange Act (15 U.S.C. 78p(a)), or for foreign private issuers as defined by Rule 3b-4(c) (17 CFR 240.3b-4(c)), any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F (17 CFR 249.220f), purchased or sold shares or other units of the class of the issuer’s equity securities that are registered pursuant to section 12 of the Exchange Act and subject of a publicly announced plan or program within four (4) business days before or after the issuer’s announcement of such repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program. □

This table must be tagged with iXBRL.

Details of Form 10-K Changes for Share Repurchase Disclosure Modernization

The three changes to Form 10-K from the Share Repurchase Disclosure Modernization Final Rule are:

-

- 1. Part II Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. The old month-by-month table of share repurchases has been removed. New language in S-K Item 703 requires narrative disclosure of the rationale and purpose of share repurchases. These changes are effective for the first full fiscal quarter beginning on or after October 1, 2023. This disclosure is required for all quarters, including the fourth quarter. Thus, the first time that this will appear in Form 10-K for calendar year-end companies is the 10-K for the year ended December 31, 2023.

(Note: New exhibit 26 requires daily details of share repurchases.)

-

- 2. Part II – Item 9B. Other Information now requires disclosure of company Rule 10b5-1 plans. The transition for this new disclosure is the same as for number 1 above.

- 3. Part VI – Item 15. – Exhibits. New exhibit 26 requires daily details of share repurchases. The transition for this new disclosure is the same as for number 1 above.

1. The mechanics of the changes to Part II Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities, begin with the addition of this new paragraph (c) to the instructions for Part II Item 5 of the form:

Item 5. . Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

***

(c) Furnish the information required by Item 703 of Regulation S-K (§ 229.703 of this chapter) for any repurchase made in the fourth quarter of the fiscal year covered by the report.

Revised S-K Item 703 is reviewed above in the section addressing the related change in Form 10-Q Part II – Item 2.

2. The mechanics of the changes to Part II Item 9B. Other Information begin with the addition of S-K Item 408(d) to paragraph (b) of the Item 9B instructions:

(b) Furnish the information required by Items 408(a) and 408(d) of Regulation S-K (§§ 229.408(a) and 229.408(d)of this chapter).

New S-K Item 408 is reviewed above in the section addressing the related change in Form 10-Q Part II – Item 5.

3. The mechanics of the change to Item 15. Exhibit and Financial Statement Schedules are to add new exhibit 26, which is discussed above with the related changes to Part II – Item 6 of Form 10-Q.

As always, your thoughts and comments are welcome!

_______________________________________________________________________

As mentioned above, below are the detailed requirements for new exhibit 26:

(26) Purchases of equity securities by the issuer and affiliated purchasers.

(i) Every issuer that has a class of equity securities registered pursuant to section 12 of the Exchange Act (15 U.S.C. 781) that files quarterly reports on Form 10-Q or an annual report on Form 10-K must file, in the following tabular format, an exhibit to those reports disclosing, for the period covered by the report (or the issuer’s fourth fiscal quarter, in the case of an annual report on Form 10-K), the total purchases made each day by or on behalf of the issuer or any “affiliated purchaser,” as defined in § 240.10b-18(a)(3) of this chapter, of shares or other units of any class of the issuer’s equity securities that are registered by the issuer pursuant to section 12 of the Exchange Act.

(ii) The information provided pursuant to this paragraph (b)(26) must be provided in an Interactive Data File as required by § 232.405 of this chapter (Rule 405 of Regulation S-T) in accordance with the EDGAR Filer Manual.

(iii) This paragraph (b)(26) shall not apply to an investment company registered under the Investment Company Act of 1940 (15 U.S.C. 80a-1 et seq.).

(iv) Disclose in the table:

(A) The date, which is the date on which the purchase of shares (or units) is executed (column (a));

(B) The class of shares (or units), which should clearly identify the class, even if the issuer has only one class of securities outstanding (column (b));

(C) The total number of shares (or units) purchased on this date, which includes all shares (or units) purchased by or on behalf of the issuer or any affiliated purchaser, regardless of whether made pursuant to publicly announced repurchase plans or programs (column (c));

(D) The average price paid per share (or unit), which shall be reported in U.S. dollars and exclude brokerage commissions and other costs of execution (column (d));

(E) The total number of shares (or units) purchased on this date as part of publicly announced repurchase plans or programs (column (e));

(F) The aggregate maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the publicly announced repurchase plans or programs (column (f));

(G) Total number of shares (or units) purchased on this date on the open market, which includes all shares (or units) repurchased by the issuer in open-market transactions, and does not include shares (or units) purchased in tender offers, in satisfaction of the issuer’s obligations upon exercise of outstanding put options issued by the issuer, or other transactions (column (g));

(H) Total number of shares (or units) purchased on this date that are intended by the issuer to qualify for the safe harbor in § 240.10b-18 of this chapter (Rule 10b-18) (column (h)); and

(I) Total number of shares (or units) purchased on this date pursuant to a plan that is intended by the issuer to satisfy the affirmative defense conditions of § 240.10b5-1(c) of this chapter (Rule 10b5-1(c)) (column (i)).

(v) Disclose, by footnote to the table, the date any plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) for the shares (or units) in column (i) was adopted or terminated.

(vi) In determining whether to check the box under “Issuer Purchases of Equity Securities,” the issuer may rely on the following, unless the issuer knows or has reason to believe that a form was filed inappropriately or that a form should have been filed but was not:

(A) A review of Forms 3 and 4 (§§ 249.103 and 249.104 of this chapter) and amendments thereto filed electronically with the Commission during the issuer’s most recent fiscal year;

(B) A review of Form 5 (§ 249.105 of this chapter) and amendments thereto filed electronically with the Commission with respect to the issuer’s most recent fiscal year;

(C) Any written representation from the reporting person that no Form 5 is required.

The issuer must maintain the representation in its records for two years, making a copy available to the Commission or its staff upon request; and

(D) For foreign private issuers, any written representations from the directors and senior management who would be identified pursuant to Item 1 of Form 20-F, provided that the reliance is reasonable. The issuer must maintain the representation in its records for two years, making a copy available to the Commission or its staff upon request.