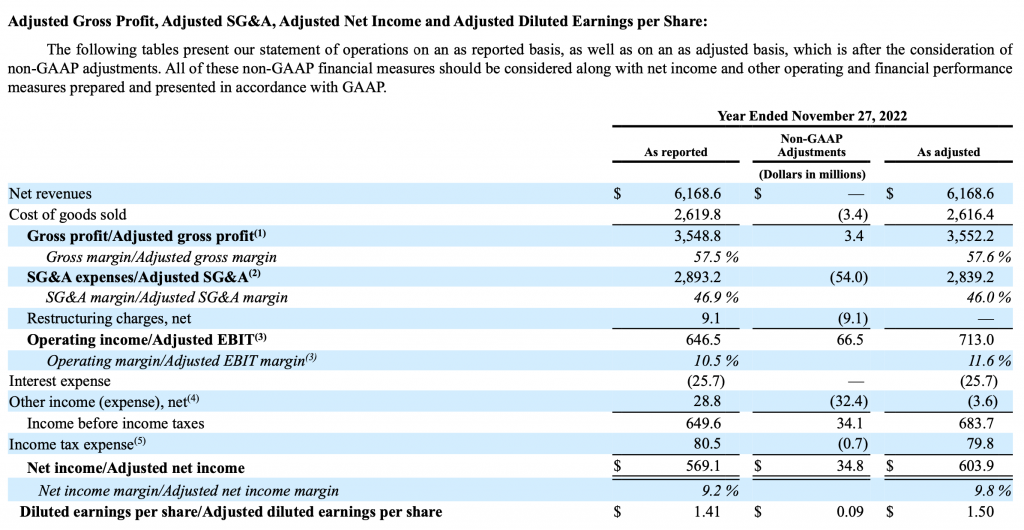

Levi Strauss & Co. included the following “schedule” to reconcile various non-GAAP measures to the most directly comparable GAAP measures in its Form 10-K for the year ended November 27, 2022:

As you review this schedule (also take note of the very last line, it has a sort of hidden non-GAAP measure problem), it is apparent that the company did not follow a long-standing position of the staff as stated in this Compliance and Disclosure Interpretation (C&DI):

Question 102.10

Question 102.10(a): Item 10(e)(1)(i)(A) of Regulation S-K requires that when a registrant presents a non-GAAP measure it must present the most directly comparable GAAP measure with equal or greater prominence. This requirement applies to non-GAAP measures presented in documents filed with the Commission and also earnings releases furnished under Item 2.02 of Form 8-K. Are there examples of disclosures that would cause a non-GAAP measure to be more prominent?

Answer: Yes. This requirement applies to the presentation of, and any related discussion and analysis of, a non-GAAP measure. Whether a non-GAAP measure is more prominent than the comparable GAAP measure generally depends on the facts and circumstances in which the disclosure is made. The staff would consider the following to be examples of non-GAAP measures that are more prominent than the comparable GAAP measures:

-

-

- Presenting an income statement of non-GAAP measures. See Question 102.10(c).

(Note: Balance of the C&DI is omitted)

The above C&DI works in tandem with this incremental discussion of what is considered a non-GAAP income statement:

Question 102.10(c): The staff considers the presentation of a non-GAAP income statement, alone or as part of the required non-GAAP reconciliation, as giving undue prominence to non-GAAP measures. What is considered to be a non-GAAP income statement?

Answer: The staff considers a non-GAAP income statement to be one that is comprised of non-GAAP measures and includes all or most of the line items and subtotals found in a GAAP income statement. [December 13, 2022]

As you would expect, the prominence of this information in Levi Strauss and Co.’s Form 10-K resulted in a comment based on the above C&DIs:

Form 10-K for the Fiscal Year Ended November 27, 2022

Management’s Discussion and Analysis of Financial Condition and Results of Operations Non-GAAP Financial Measures

Adjusted Gross Profit, Adjusted SG&A, Adjusted Net Income and Adjusted Diluted Earnings per Share, page 58

-

- We note that you appear to present full income statements to reconcile your non-GAAP measures on pages 58 and 59. Please tell us your consideration of Questions 102.10(a), 102.10(b), and 102.10(c) of the Compliance and Disclosure Interpretations on Non-GAAP Financial Measures and Item 10(e)(1)(i)(A) of Regulation S-K. This comment also applies to your Form 10-Q for the quarter ended February 26, 2023 and Exhibit 99.1 to Form 8-K furnished on January 25, 2023.

The company’s response was direct and to the point, but unfortunately did not address the presentation of the last line in the schedule above:

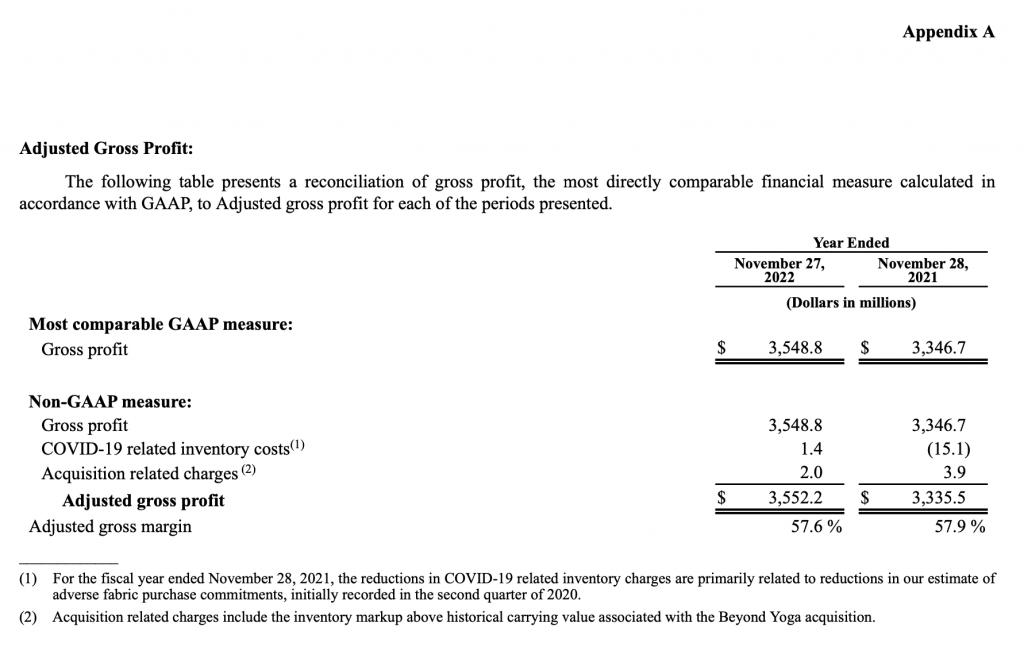

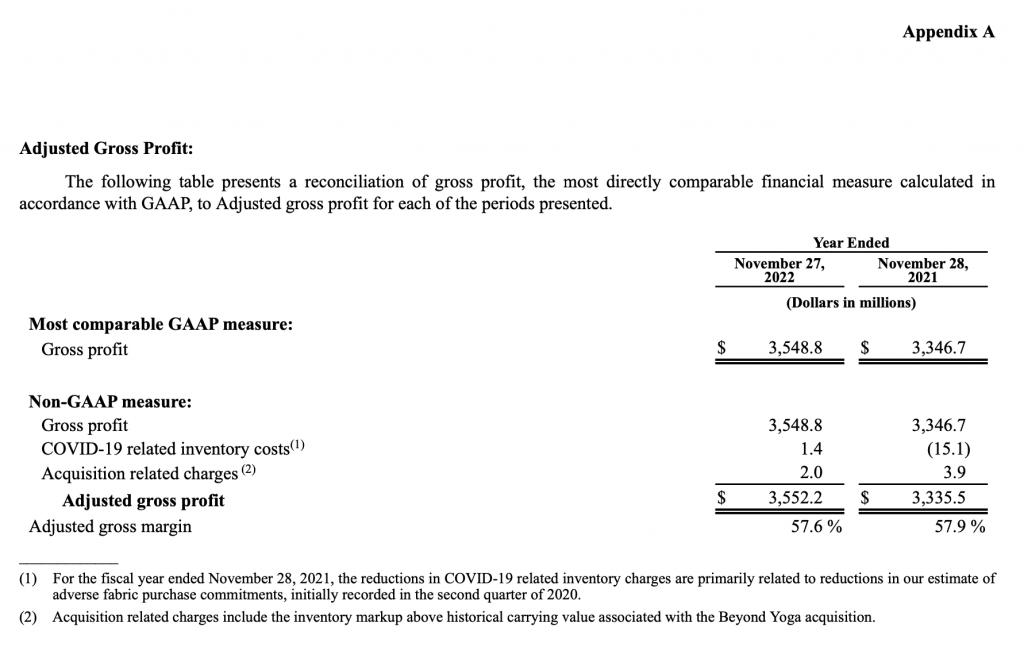

The Company respectfully acknowledges the Staff’s comment and confirms that in future filings it will reconcile its non-GAAP measures to the most directly comparable GAAP measures without presenting a non-GAAP income statement. The Company expects that this will be substantially similar to the reconciliation included in Appendix A, which has been illustratively amended for the Staff’s reference.

Appendix A provided individual reconciliations for the non-GAAP measures in the original non-GAAP income statement. Here is an example of one of the schedules:

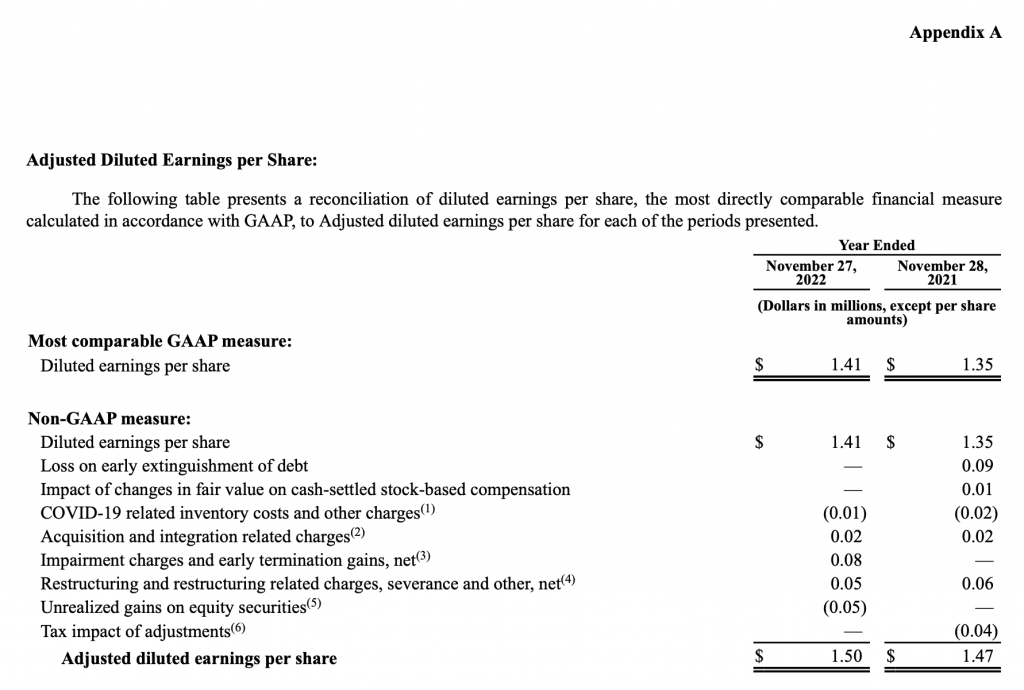

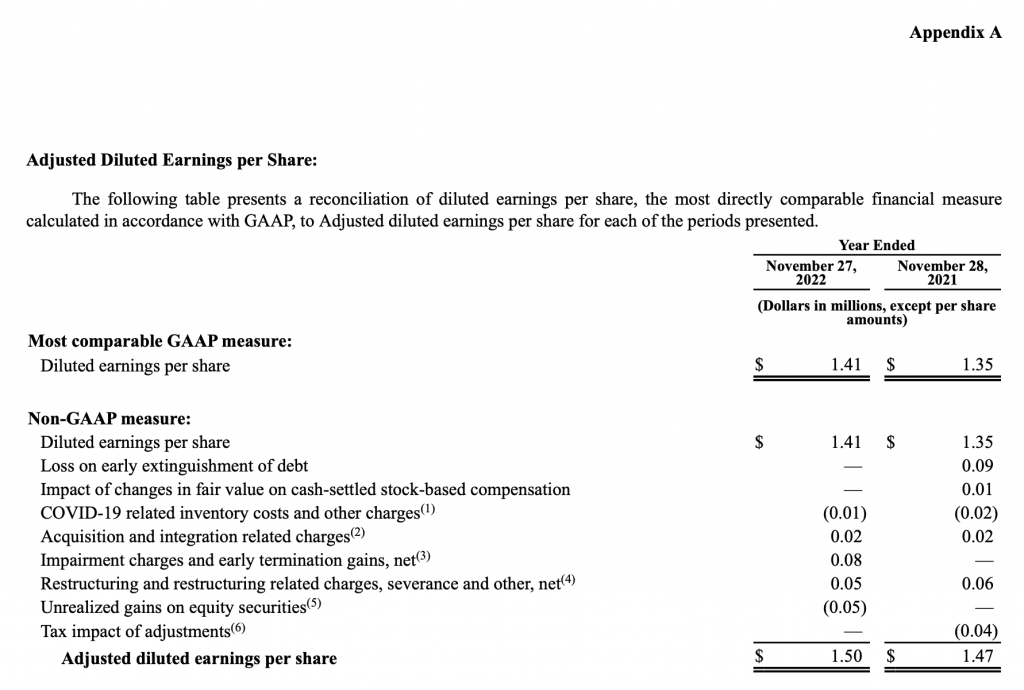

However, this was not the end of the comment process. Because the information presented by Levi Strauss includes a non-GAAP EPS amount, the SEC issued this follow-on comment:

- We note that on the last page of Appendix A, you disclose Adjusted Diluted Earnings Per Share at the bottom of your reconciliation of net income to Adjusted Net Income. Please revise to present a reconciliation of diluted EPS to Adjusted Diluted EPS. Additionally, wherever you present a Non GAAP margin measure in Appendix A, please revise to disclose the most comparable margin presented in accordance with GAAP.

The company’s response included an appropriate reconciliation:

The Company respectfully acknowledges the Staff’s comment and confirms that the Company will present a reconciliation of diluted EPS to Adjusted Diluted EPS and include comparable margins presented in accordance with GAAP whenever we present a non-GAAP margin measure in future periodic filings. The Company expects that this will be substantially similar to the reconciliation included in Appendix A, which has been illustratively amended for the Staff’s reference.

After this response the staff sent Levi Strauss and Co. a closing letter.

As always, your thoughts and comments are welcome!