As we discussed in the preceding post in this series, non-GAAP measures have been at or near the top of frequent SEC comment letter topics for several years. The earlier post explored Rite Aid’s adjustment for “facility exit and impairment charges” in its computation of Adjusted EBITDA along with a first round SEC comment about this presentation and the company’s initial response.

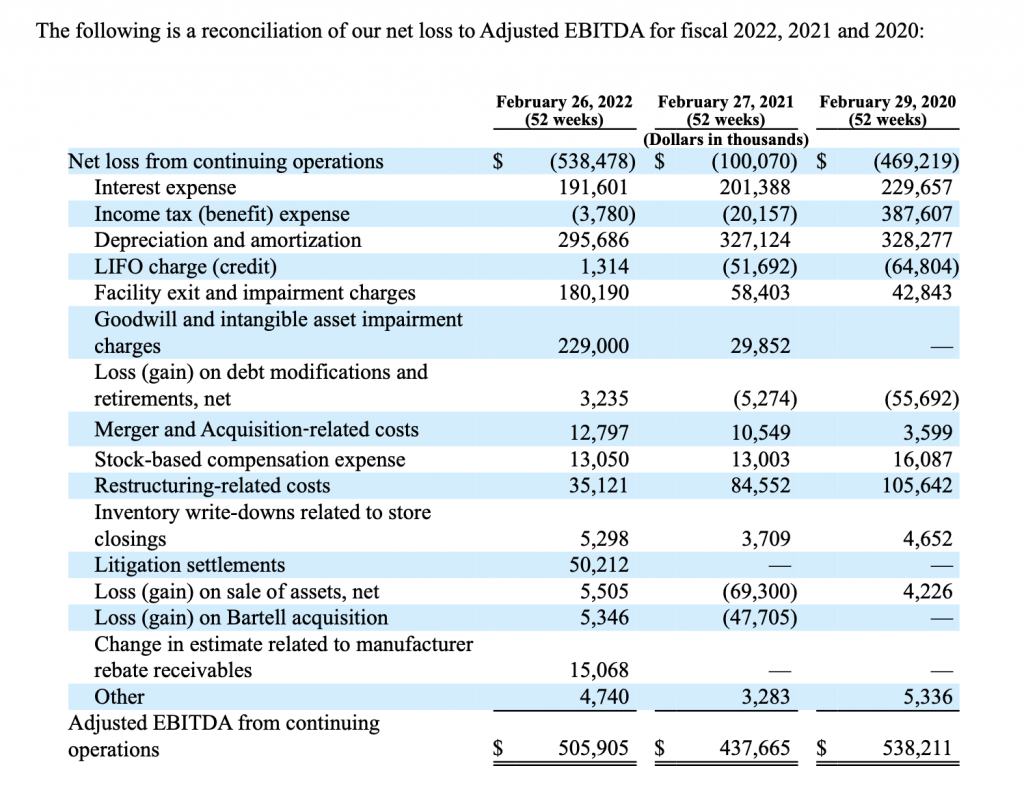

As a reminder, here is Rite Aid’s reconciliation for adjusted EBITDA:

After receiving the company’s first response, the SEC issued this follow-on comment on March 30, 2023:

With regard to the adjustment to exclude facility exit charges, you state that your presentation of Adjusted EBITDA eliminates charges that “do not reflect ongoing operations and underlying operational performance.” We note, however, that you have incurred facility exit charges, inventory write-downs related to store closings, and restructuring-related costs for the last 6, 6, and 4 years, respectively, and in the 39 week period ending November 26, 2022. We also note from your response that your 2022 strategic initiative resulted in the expectation of closing 195 stores, of which only 48 were closed in 2022. In your third quarter 2023 earnings call, you indicated that in building out your plans for 2024, you will continue to look at opportunities to close stores. Based on the consistency with which you have incurred such costs in the past and the apparent expectation that such costs will be incurred in the future, it appears these costs are normal for your business. Had an investor disregarded such costs several years ago on the basis that they would not be reflective of your future ongoing operations, it appears their expectations would have varied significantly from your actual subsequent results. To the extent you continue to adjust for facility exit charges, inventory write-downs related to store closings, and restructuring-related costs, please revise to disclose a substantive reason, specific to you, of usefulness to investors, to disclose your history of incurring such costs, and to provide appropriate cautionary language regarding the likelihood of you incurring such costs in the future.

The language in this follow-on comment clearly articulates CorpFin’s concerns about how investors could interpret and potentially be misled by this adjustment.

In the company’s next response, it appears there were further discussions with the staff and the company stated:

In response to the Staff’s additional feedback on the Company’s disclosure around continued adjustments to Adjusted EBITDA and Adjusted Net Income (Loss), as applicable, related to facility exit charges, inventory write-downs related to stores closings, and restructuring charges, the Company acknowledges and confirms that in future filings the Company will provide the requested enhanced disclosure. The Company will also continually evaluate the appropriateness of adjustments to its non-GAAP measures based upon the nature of the activity within the specific period presented within the purview of the Company’s current financial reports. Please find attached, as Exhibit A, the supplemental non-GAAP measures disclosure for the upcoming Form 10-K for the fiscal year ended March 4, 2023, which illustrates the Company’s intended revised disclosure, in accordance with the Staff’s comment, in addition to existing reconciliation and related disclosures.

Here is the updated disclosure the company presented to the staff:

We present these non-GAAP financial measures in order to provide transparency to our investors because they are measures that management uses to assess both management performance and the financial performance of our operations and to allocate resources. In addition, management believes that these measures may assist investors with understanding and evaluating our initiatives to drive improved financial performance and enables investors to supplementally compare our operating performance with the operating performance of our competitors including with those of our competitors having different capital structures. While we have excluded certain of these items from historical non-GAAP financial measures, there is no guarantee that the items excluded from non-GAAP financial measures will not continue into future periods. For instance, we expect to continue to experience charges for facility exit and impairment charges and inventory write-downs related to store closures as the Company continues to complete a multi-year strategic initiative designed to improve overall performance. We also expect to continue to experience and report restructuring-related charges associated with continued execution of our strategic initiatives.

Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share or other non-GAAP measures should not be considered in isolation from, and are not intended to represent an alternative measure of, operating results or of cash flows from operating activities, as determined in accordance with GAAP. Our definition of these non-GAAP measures may not be comparable to similarly titled measurements reported by other companies, including companies in our industry.

With this explanation, the SEC issued its closing letter and the company, with the additional disclosure, was not required to change its presentation.

As always, your thoughts and comments are welcome.

Great post and very informative.

Thanks Joe! Hope all is going well!