Non-GAAP measures have been at or near the top of frequent SEC comment letter topics for several years. While some non-GAAP comments deal with straightforward issues such as not presenting the related GAAP measure with equal or greater prominence, other comments focus on more complex issues.

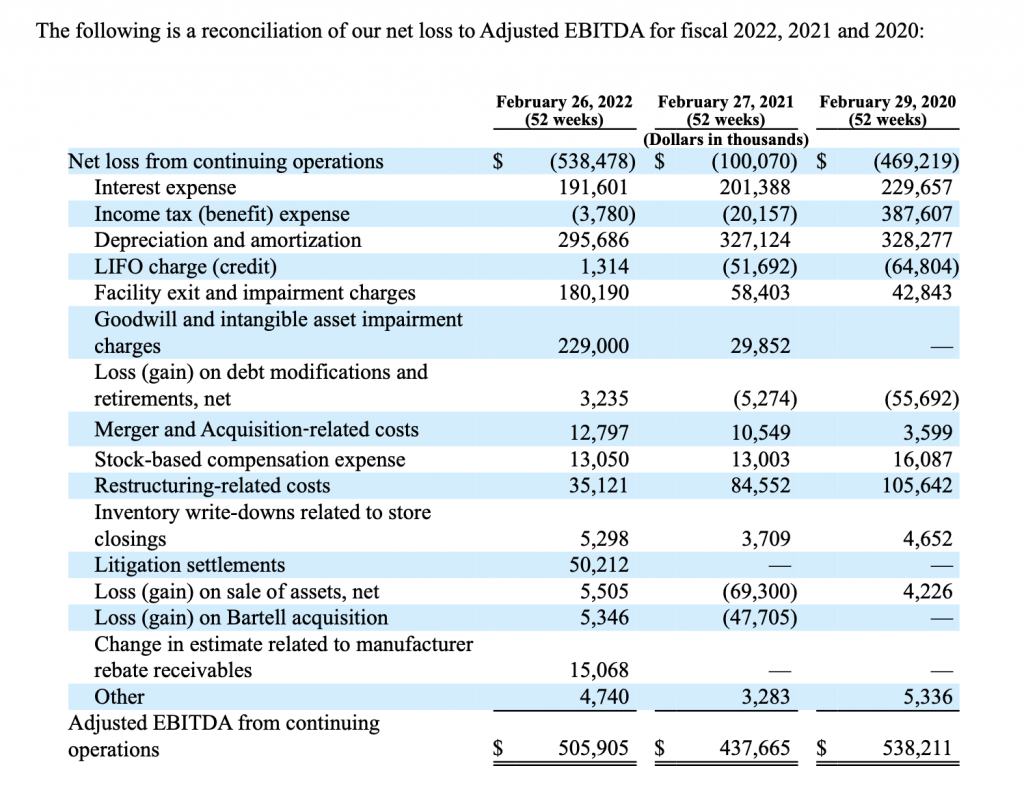

The presentation that Rite Aid used for “facility exit and impairment charges” in its presentation of Adjusted EBITDA presents one of these complex issues. Below is Rite Aid’s reconciliation for its presentation of adjusted EBITDA:

Rite Aid also included this narrative disclosure about adjusted EBITDA:

In addition to net income (loss) determined in accordance with GAAP, we use certain non-GAAP measures, such as “Adjusted EBITDA”, in assessing our operating performance. We believe the non-GAAP measures serve as an appropriate measure in evaluating the performance of our business. We define Adjusted EBITDA as net income (loss) excluding the impact of income taxes, interest expense, depreciation and amortization, LIFO adjustments (which removes the entire impact of LIFO, and effectively reflects the results as if we were on a FIFO inventory basis), charges or credits for facility exit and , goodwill and intangible asset impairment charges, inventory write-downs related to store closings, gains or losses on debt modifications and retirements, and other items (including stock-based compensation expense, merger and acquisition- related costs, non-recurring litigation settlements, severance, restructuring-related costs, costs related to facility closures, gain or loss on sale of assets, the gain or loss on Bartell acquisition, and the change in estimate related to manufacturer rebate receivables). We reference this particular non-GAAP financial measure frequently in our decision-making because it provides supplemental information that facilitates internal comparisons to the historical periods and external comparisons to competitors. In addition, incentive compensation is primarily based on Adjusted EBITDA and we base certain of our forward-looking estimates on Adjusted EBITDA to facilitate quantification of planned business activities and enhance subsequent follow-up with comparisons of actual to planned Adjusted EBITDA.

While these disclosures are detailed, the SEC focused on facility exit and impairment charges in a letter dated February 21, 2023:

- We note in calculating Adjusted EBITDA you excluded facility exit charges. The adjustment appears to remove a normal, recurring, operating expense. Additionally, we note you exclude the change in estimate related to manufacturer rebate receivable which appears to result in an individually tailored recognition and measurement method. Please tell us how these adjustments are appropriate or revise your presentation to omit these adjustments. Refer to Questions 100.01 and 100.04 of the Staff’s Compliance and Disclosure Interpretations on Non-GAAP Financial Measures. Our comment also applies to Adjusted Net Income (Loss).

In this post we will discuss the issue surrounding the facility exit charges. We will explore the manufacturer rebate issue in a later post. With respect to the facility exit charges, the C&DI that the staff is referring to about this adjustment was updated in December 2022:

Question 100.01

Question: Can certain adjustments, although not explicitly prohibited, result in a non-GAAP measure that is misleading?

Answer: Yes. Certain adjustments may violate Rule 100(b) of Regulation G because they cause the presentation of the non-GAAP measure to be misleading. Whether or not an adjustment results in a misleading non-GAAP measure depends on a company’s individual facts and circumstances.

Presenting a non-GAAP performance measure that excludes normal, recurring, cash operating expenses necessary to operate a registrant’s business is one example of a measure that could be misleading.

When evaluating what is a normal, operating expense, the staff considers the nature and effect of the non-GAAP adjustment and how it relates to the company’s operations, revenue generating activities, business strategy, industry and regulatory environment.

The staff would view an operating expense that occurs repeatedly or occasionally, including at irregular intervals, as recurring. [December 13, 2022]

The company’s response on March 13, 2023, reviewed the calculation and explained their rationale for the adjustment for facility exit costs:

Adjusted EBITDA has long been used by the Company’s management and investors as one of the primary measures to evaluate both Company and management performance. The Company believes that the current methodology in calculating Adjusted EBITDA appropriately eliminates certain charges that do not reflect ongoing operations and underlying operational performance. The Company’s facility exit charges are costs associated with the closure of stores, distribution centers and corporate facilities and include establishing, at net present value, a liability for future costs associated with the exit activity pursuant to ASC 420-10. During fiscal year 2022, the Company announced a Board-approved multi-year strategic initiative designed to improve overall performance by reducing costs, driving improved profitability, and ensuring that the Company has a healthy foundation to grow from by eliminating underperforming stores. This initiative resulted in the expectation of closing 195 stores, of which 48 were closed in FY22 with the remainder expected to close in future periods. In addition, the strategic plan also included plans to exit certain corporate facilities as the Company moved toward its remote-first workplace strategy. Because the decision to close these facilities was part of a significant strategic project, the magnitude of the store closures was greater than what would be expected as part of ordinary business, and these facilities no longer have an impact on the Company’s present and go-forward operations, revenue generating activities or business strategy, the Company has determined that these costs do not constitute normal operating activities represented by Adjusted EBITDA and that excluding facility exit charges from its calculation of Adjusted EBITDA does not result in a non-GAAP measure that is misleading under the criteria in Question 100.01 of the Staff’s Compliance and Disclosure Interpretations on Non-GAAP Financial Measures. In addition to using Adjusted EBITDA as a primary measure to evaluate Company and management’s performance, the Company’s senior secured credit facility agreement (“SSCF”) defines Consolidated EBITDA as excluding facility exit charges and, as the calculation of its key credit ratios in the agreement are tied to Consolidated EBITDA, the Company believes that it is appropriate for its publicly disclosed measurement of Adjusted EBITDA to closely conform with the definition of Consolidated EBITDA in its SSCF to provide investors with clear line of sight into its credit metric calculations.

After Rite Aid made this response, the SEC issued a follow-on comment. Our next post will explore the follow-on comment, the company’s response, and the resulting change in disclosure.

As always, your thoughts and comments are welcome!