As we discussed in a prior post, three parts of the SEC’s 2020 MD&A modernization have become focus areas in the comment process:

-

- Critical accounting estimate disclosures

- Quantitative and qualitative disclosures about material changes

- Meaningfully addressing liquidity and capital resources disclosures

We also explored how one of the reasons behind this increase in MD&A comments could be that companies are reluctant to change MD&A, even when the change is to comply with a new rule or to improve MD&A!

In earlier posts we explored comment letter exchanges focused on critical accounting estimate disclosures and quantitative and qualitative disclosures about material changes.

Today’s post examines an example comment and company response for the third of these three areas, meaningfully addressing liquidity and capital resources disclosures.

The Regulation S-K Item 303 guidance for this disclosure is very big picture:

Analyze the registrant’s ability to generate and obtain adequate amounts of cash to meet its requirements and its plans for cash in the short-term (i.e., the next 12 months from the most recent fiscal period end required to be presented) and separately in the long-term (i.e., beyond the next 12 months). The discussion should analyze material cash requirements from known contractual and other obligations.

……..

Describe the registrant’s material cash requirements, including commitments for capital expenditures, as of the end of the latest fiscal period, the anticipated source of funds needed to satisfy such cash requirements and the general purpose of such requirements.

It is important to note that the language “cash requirements” does not limit the disclosure to contractual obligations, but all reasonably likely cash requirements. This in essences is a discussion of how the business is funded in both the long- and short-term. An important part of this analysis is clear and understandable disclosure about sources of cash and how they have varied in the past and how they could vary in the future.

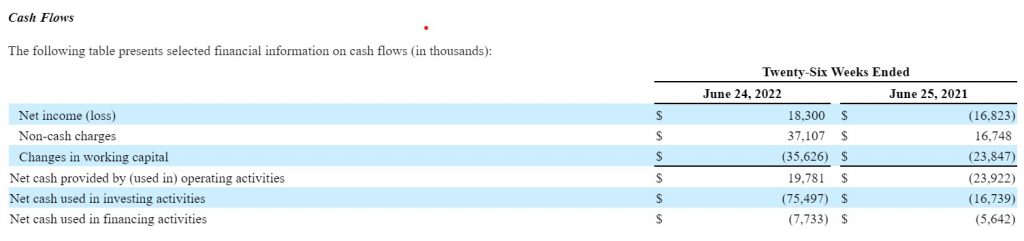

Here is an example disclosure from a company’s Form 10-Q MD&A that generated a comment to provide more meaningful disclosure about how cash is generated:

Net cash provided by operations was $19.8 million for the twenty-six weeks ended June 24, 2022 consisting of a net income of $18.3 million and $37.1 million of non-cash charges, partially offset by investments in working capital growth of $35.6 million. Non-cash charges increased $20.4 million primarily due to a $12.8 million change in deferred tax expenses and a $5.0 million increase in changes in the fair value of earn-out liabilities. The cash used for working capital growth of $11.8 million is primarily driven by the Company’s reinvestment in working capital to support sales growth.

The SEC’s comment focuses on more robust explanations for the causal factors behind changes in cash from operating activities:

Liquidity and Capital Resources Cash Flows, page 2

-

- Your analysis of changes in operating cash flows references net results, noncash charges and working capital. Note that references to these items may not provide a sufficient basis to understand how operating cash actually was affected between periods. Your analysis should discuss factors that actually affected operating cash and reasons underlying these factors. In connection with this, discuss more fully what the cash used for working capital growth primarily driven by the Company’s reinvestment in working capital to support sales growth represents and the potential for this to be a continuing trend. Refer to the introductory paragraph of section IV.B and paragraph B.1 of Release No. 33-8350 for guidance, and section 501.04 of the staff’s Codification of Financial Reporting Releases regarding quantification of variance factors. Please revise your disclosure as appropriate.

In its response, the company provided more detailed discussion about the causal factors behind the change in operating cash flows:

In response to the Staff’s comment the Company will expand its disclosure of the factors impacting operating cash flows in future filings. The following is an example of the future disclosure related to operating cash flows:

Net cash provided by operations was $19.8 million for the twenty-six weeks ended June 24, 2022, compared to net cash used in operating activities of $23.9 million for the twenty-six weeks ended June 26, 2021. The increase in cash provided by operating activities is primarily due to the increased net income, net of non-cash charges, in the current year of $55.4 million versus a loss of $0.1 million in the prior year period. This improvement in cash-based profitability is primarily due to a 65% increase in sales compared to the prior year period. The sales growth also resulted in higher working capital (increased accounts receivable and inventory partially offset by higher accounts payable). The working capital growth of $11.8 million versus the prior year period partially offset the favorable impact of increased profitability. The Company’s increased working capital investment in the current year is the result of rapid sales growth driven by the Company’s recovery from the pandemic. The Company expects working capital growth to moderate in the future as sales growth normalizes.

Each of the three MD&A areas addressed in our “Getting Ahead of the MD&A Update Curve” series was changed in the SEC’s 2020 modernization rule, which has been in effect for two years. SEC comments, like those discussed in this series, can be easily avoided by assuring your MD&A appropriately addresses each area.

As always, your thoughts and comments are welcome!